Open Range Break-out... a Birger Schäfermeier strategy

Description

The Open Range Break-out strategy is one of two strategies in Birger Schäfermeier’s Morning Strategies package. The package was designed and programmed by Birger for the NanoTrader Full platform. The strategy analyses the price levels an instrument reaches in the first market hour. These levels are used as entry levels for a potential trade. Birger Schäfermeier uses the strategy to trade the Dax, the Eurostoxx and the Bund in the morning and to trade the S&P 500 in the afternoon. The strategy can be used for futures and CFDs.

Click here to buy Birger Schäfermeier’s Morning Strategies package in the store

The strategy in detail

Birger Schäfermeier places his orders at 9h00 (or at 16h15 for the S&P 500). Before placing his orders he determines the market trend. To determine the market trend Birger uses the SuperTrend indicator.

Note: the SuperTrend indicator is included in the strategy. If the trend is positive, the indicator colours the chart background green. If the trend is negative, the indicator colours the chart background red. Birger uses 30 calendar days of data for the SuperTrend.

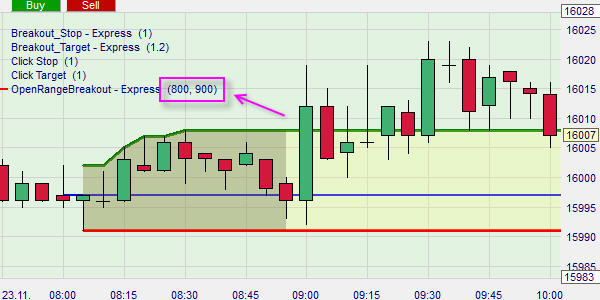

Birger Schäfermeier uses the highest/lowest price levels reached during the first 60 minutes to place his orders. For the S&P 500, which Birger trades in the afternoon, he uses the highest/lowest price level after the first 45 minutes.

Note: the strategy shows the price levels at which Birger Schäfermeier places his orders in the chart. The price levels are represented by a green and a red line.

When to open a position?

Birger Schäfermeier will place a buy stop order on the green line when the market is in a positive trend. If the market is in a negative trend he will place a short sell stop order on the red line.

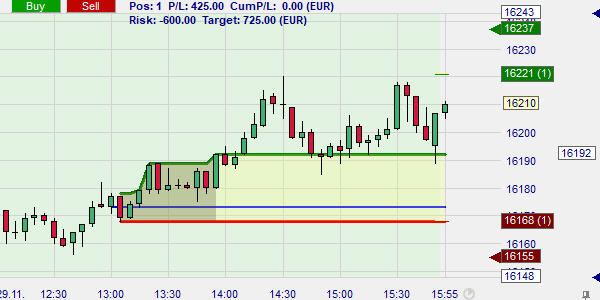

This example shows the Dax in a positive trend (green chart background). Birger placed a buy stop order on the green line at 9h00. The market goes down. The order is never reached. Birger cancels the order at his discretion. There is no fixed rule when a non-executed order is cancelled.

This example shows the Dax in a positive trend (green chart background). Birger placed a buy stop order on the green line at 9h00. The order was reached and a long position was bought.

When to close a position?

The Open Range Break-out strategy uses both a target and a stop. The stop is placed on the other extreme of the first 60 minutes price range. For example, if you buy on the green line, the stop is on the red line. Birger Schäfermeier opts for a return/risk ratio of 3. As a consequence the target is placed at 3x the distance of the stop.

Using the price range of the first 60 minutes to determine the stop and target can sometimes result in a stop and a target which are far away. Birger Schäfermeier remedies this inconvenience by inserting an additional pair of stop and target orders into his strategy. These additional orders are recognizable by a small triangle in front of their price level. If Birger thinks the stop and target are too far away he will slide these additional orders (click on the triangle and drag) to price levels which are closer. When the position is opened and if you activated the TradeGuard, the strategy will automatically place all four orders. Like Birger Schäfermeier you can then determine which pair of orders you use.

This example shows the four close orders related to an open position. Birger Schäfermeier will either use the fixed orders based on his return/risk ratio (purple) or, if he considers these orders too far removed, he will use the alternative orders (orange). He will slide these alternative orders to price levels closer to the market price than the two other orders.

When one of these orders is executed, the remaining orders are cancelled automatically

Birger Schäfermeier does not keep positions overnight. Therefore he included a time filter in his strategy. The time filter, if ticked and if the TradeGuard is activated, will automatically close the open position at the market price at 21h59.

Click here to buy Birger Schäfermeier’s Morning Strategies package in the webshop

Practical implementation

If you are not yet familiar with the NanoTrader Full platform, please visit the quick start page.

Getting started

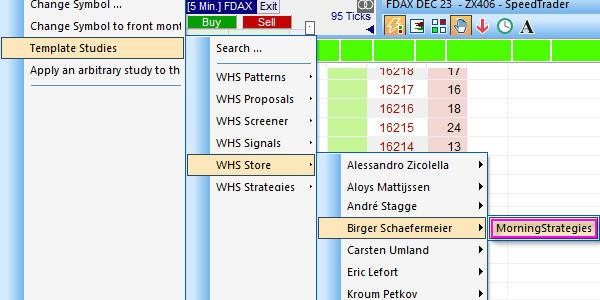

Step 1: activate Birger Schäfermeier’s strategy. Right-click the instrument you wish to trade and activate the relevant strategy. The strategy's chart is set to a 5-minute timeframe. It is advisable not to change the timeframe.

Step 2: if you want to trade the S&P 500 you need to change the values of these two parameters:

| S&P 500 (future or CFD) | |

|---|---|

| Market open time | 1530 |

| EndTime | 1615 |

You can change these values in the DesignerBar:

Or you can change the values directly in the chart (click the relevant value and use the mouse wheel or the keyboard):

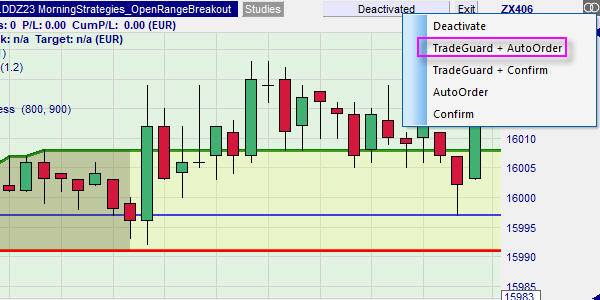

Step 3: activate the TradeGuard. The TradeGuard will automatically place the stop and target orders after the position is opened. If one of the orders is executed, the other orders are cancelled automatically. The TradeGuard will also close any position which is still open at 21h59 if you ticked the time filter.

Birger also included a lay-out which simultaneously opens charts (Dax, Eurostox and S&P 500) for both the strategies in his Morning Strategies package. You can open this lay-out via the PageManager:

Trading

At 9h00 (or 16h15)...

If the market is in a positive trend (green chart background) place a buy stop order on the green line. If the market is in a negative trend (red chart background) place a sell stop order on the red line.

The easiest way to place the order is to click ![]() in the chart. Select stop order in the ticket. Drag the order line to the relevant price level. You do this by clicking the triangle in front of the order and dragging it to Birger’s price level.

in the chart. Select stop order in the ticket. Drag the order line to the relevant price level. You do this by clicking the triangle in front of the order and dragging it to Birger’s price level.

If your order is not executed, you need to cancel the order.

If your order is executed and you activated the TradeGuard the platform will automatically place the orders based on the price range as well as the additional order pair which can be moved by the trader. Like Birger Schäfermeier you can determine which pair of orders you use.

If your position is not closed by 21h59 and you activated the TradeGuard, it will be closed at the market price at that time.

It is worth noting that Birger Schäfermeier likes to use discretion when trading. He will not necessarily implement his strategy to the letter every day. Sometimes Birger will make changes based on his experience.

Click here to buy Birger Schäfermeier’s Morning Strategies package in the webshop