The ADR target bands

The ADR Target Bands are price target ranges based on the ADR (average daily range) of a market calculated over two different periods. You can determine the two periods in the platform yourself or you use the default settings (7 and 14).

The upper target band is calculated by adding the average daily ranges for the two periods to the current day´s low. The lower target band is calculated by subtracting the average daily ranges from the current day´s high.

The advantages of the ADR Target Bands:

- They can be used on all instruments.

- They can be used in all time frames.

- They are easy to understand.

- They offer targets for the market price and thus can be used as stops and targets.

- They can be used as trading signals to open a position.

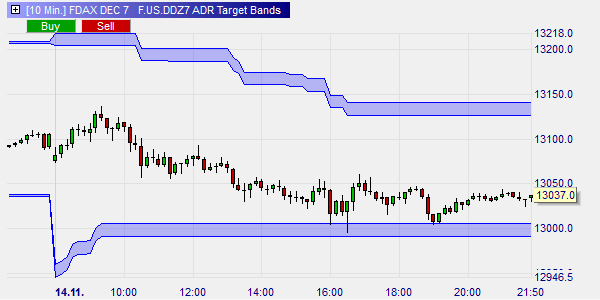

This example shows the ADR Target Bands on the DAX future in a 10-minute chart. The down move stopped when the lower target band based was reached.

In addition to using the ADR Target Bands as targets, some traders open a long position when the market price reaches the lower band and a short sell position when the market price reaches upper band.

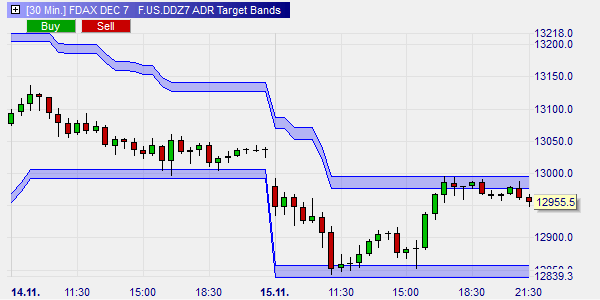

This example shows three potential trading signals; two buy signals and one short sell signal.