Placing orders easily and efficiently

To accommodate every trading style, orders can be placed in many different ways. The order execution will always be high speed and error free.

| On this page... |

| Bracket orders |

| TradeWizard |

| Automating orders |

| Scalping orders |

| Time orders |

Opening an account is FREE. There is no monthly inactivity fee.

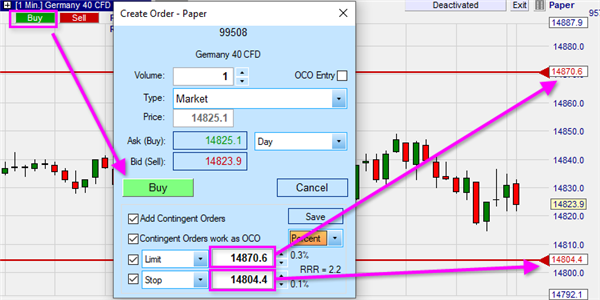

Bracket orders or contingent orders

Clicking the Buy or Sell buttons in the chart opens the order ticket. This trader is placing a market order. By selecting "Add Contingent Orders" he instructs the platform to automatically place a target and a stop order after he launches his market order. These are the horizontal red lines. It is possible to slide these orders in the chart.

In this example the trader places the stop loss order on a support level. When one of the orders is executed, the platform automatically cancels the other order. This is called 'OCO', one cancels other.

The TradeWizard

The TradeWizard in NanoTrader allows novice traders to place their orders without making an error. The wizard takes the trader step-by-step through the order process. An error is not possible. Every client also gets a permanent demo account to practice placing orders.

Semi-automated and automated orders

In semi-automated trading the trader opens the position manually and instructs the platform to close the position automatically when his criteria are met. In automated trading the platform opens and closes positions automatically.

"I

have already familiarized myself with the platform and

would like to tell you that this is the best platform I

have been able to work on so far, congratulations on this

cool tool." - Peter

Open an account too

"I

didn't have such fantastic service with my two previous

brokers. Everything works perfectly so far. It's much more

fun this way." - Achim

Open an account too

The Speedtrader

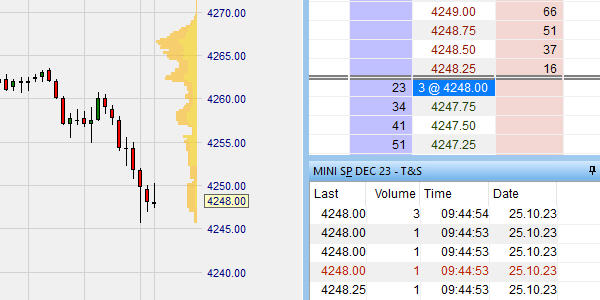

The Speedtrader order-book

Orders can be placed in the order-book. Click in the relevant column to place the order at the desired price level.

The Speedtrader orderpad

The orderpad contains buttons to place one-click orders and buttons to manage orders.

These one-click buttons for orders are available:

- Buy at the market price

- Sell at the market price

- Buy 1 more

- Sell 1

- Reverse position

- Double position

- Always keep my buy on the bid

- Always keep my sell on the ask

The ChartTrader

The unique ChartTrader can be added to every chart. By clicking in the ChartTrader market, limit and stop orders can be placed in one click.

FREE Newsletter for Traders

New indicators, new strategies... everything you need to know.

You can unsubscribe at any moment.

Register nowPlacing orders in the chart

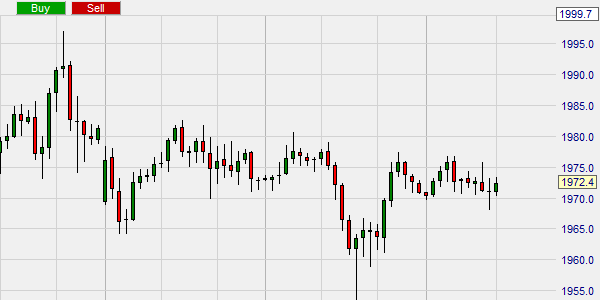

Every chart contains a quick-action Buy and a Sell button. These buttons are one of the most popular methods of placing an order.

Sliding orders in the chart

Traders can grab any working order in the chart and simply slide it to a new price level. There is no need to cancel and replace.

Right-click an order in the chart to cancel it.

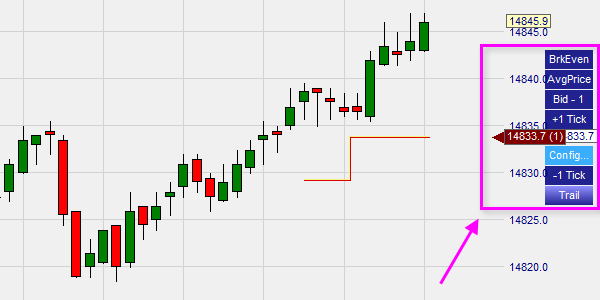

The Tactic buttons and orders

Scalping and day trading with surgical precision

Traders he blue Tactic buttons in their charts. These buttons manage orders and positions with speed and precision.

The buttons are used a lot in daytrading and scalping.

In one click you can:

- Convert a stop into a trailing stop or a break-event stop

- Increase the stop by 1 tick

- Lower the stop by 1 tick

- Join the bid price

- Join the ask price

- Join the bid price +1

- Join the ask price +1

Your indicators place orders

Tactic Orders is an easy way to automate orders. It is perfect for traders, who use indicators. This trader uses three indicators and selected "Unanimity". If all three indicators are bearish, a position is bought. The orders can be placed automatically or only after approval by the trader.

Time-based orders

'Good after time' orders

Market, stop and limit orders with the instruction 'Good After Time' are activated at a particular point in time chosen by the trader.

'Good between' orders

Market, stop and limit orders with the instruction 'Good Between' are activated and cancelled at times chosen by the trader.

Did you know?

Most trading platforms cannot handle orders with time instruction. For NanoTrader this is child's play.

The advantages of time-based orders

- Orders are placed at a time of your choice.

- Orders are cancelled at a time of your choice.

- Place the orders when you want.

- No extra cost.

- Easy to use.

- Switch of the PC (futures) or keep it running (CFD-Forex)

Quick and easy account opening

Trade with an award-winning broker.

No monthly inactivity fee

FREE trading strategies and signals.

Unique trading store.

Open an account

WH SELFINVEST S.A., founded in 1998, has a broker license (nr. 42798), a commissionaire license (nr. 36399) and a portfolio manager license (nr. 1806) granted by the Luxemburg Ministry of Finance. The company is supervised by the "Commission de Surveillance du Secteur Financier". Based on its European passport, the company maintains: a branch office in France (nr. 18943 acpr) which is also subjected to the supervision of the "Autorité de Contrôle Prudentiel et de Résolution" (ACPR) and the "Banque de France", and a branch office in Germany (nr. 122635) which is also subjected to the supervision of the "Bundesanstalt für Finanzdienstleistungsaufsicht" (BAFIN). In addition WH SelfInvest has a representative office in Switzerland, which is also subjected to the supervision of the "Swiss Financial Market Supervisory Authority" (FINMA), and, based on the European passport, representative offices in Belgium and the Netherlands, which were notified to the relevant competent authorities in these countries.