The Stock-box service

Is the stock-box service for you?

You do not want investment funds. The results are often disappointing, the costs are not transparent. You want a portfolio consisting of individual stocks but without the complexity of selecting the stocks yourself?

The stock-box service maintains a good stock portfolio at a low cost. Objective criteria, including Nobel Prize research, are applied to systematically replace weak stocks with strong stocks. Keeping your portfolio up-to-date is simple... one click per month is sufficient. These are some of the benefits of this popular administrative service:

Excellent results since 2016.

Stocks are selected using only objective criteria (including Nobel Prize research).

Monthly e-mail details the stocks which need to be changed in your portfolio.

Save time. One click to update your portfolio.

Save money. Pay the same low commissions as traders who place their own orders.

Follow your portfolio in real-time via tablet or smartphone.

Spread risk. Five different stock-boxes are available.

Save even more money. No management fee, no performance fee, no exit cost.

Excellent results

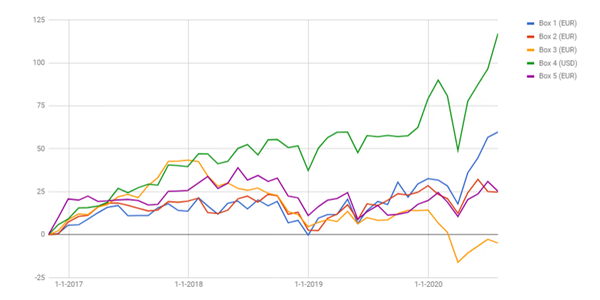

The gross returns of the five stock-boxes since 1.11.2016. Costs and dividends are not included. Leverage is not used.

Past performance is no guarantee of future results.

Selecting stocks and the Nobel Prize

With one exception, every stock-box uses a logic based on the Momentum principle discovered by Nobel Prize winner Professor Eugene Fama of the University of Chicago. In his research into the short term predictability of market prices Professor Fama could only discover one principle which consistently appeared: stocks which under-performed in the last months will continue to under-perform in the coming months and vice versa. He called this principle "Momentum". Momentum leads to a counter-intuitive conclusion: "far more money is being made by buying high (stocks which are out-performing) and selling even higher".

The stock-box service rigorously applies a logic based on Momentum. The service identifies the stocks which out-perform their index the most. Picking only winning stocks is not possible. Therefore the stock-box service quickly identifies weak stocks and replaces them by strong stocks.

How does the service work?

Open a stock account and add a copy of the stock-box information sheet to your application. Indicate on the sheet which stock-box(es) you want. Once the account is funded, it will be administered according to the Momentum principle.

Every month you receive an e-mail detailing the stocks which need to be changed in your stock-box(es). Simply click 'Yes' (or 'No') in the e-mail. Your portfolio will be updated. Simple and easy.

The five Stock-boxes

Key information

The five stock-boxes...

Invest only in big companies which are part of the most important market indices.

Invest without leverage. Risk is therefore limited.

Offer a choice of markets.

Offer a choice of currencies.

| Box 1 – The stocks recommended by analysts |

|---|

| 8 European and U.S. stocks. The stocks are selected based on the number of analyst "buy" recommendations (minimum 10) and the ratio to the 'hold' and 'sell' recommendations (minimum 200%). |

| Box 2 – The MSCI index outperformers |

| 8 European and U.S. stocks out of 600 stocks which

outperform the MSCI index over 5 and 10 years. The stocks are selected on the basis of their 3-month out-performance of the MSCI index. |

| Box 3 – The DAX 30 outperformers |

| 8 stocks which are part of the German DAX 30 market

index. The stocks are selected on the basis of their 3-month out-performance of the DAX 30 index. |

| Box 4 – The NASDAQ 100 outperformers |

| 8 stocks which are part of the American Nasdaq 100

market index. The stocks are selected on the basis of their 3-month out-performance of the NASDAQ 100 index. |

| Box 5 – The Rockets (EU & US) |

| 6 stocks, one each from the DOW, SP 100, Nasdaq 100,

DAX 30, CAC 40 and AEX market indices. The stocks are selected on the basis of their 1-month out-performance of their respective indices. |

See which stocks are currently selected? Download the stock-box information sheet.

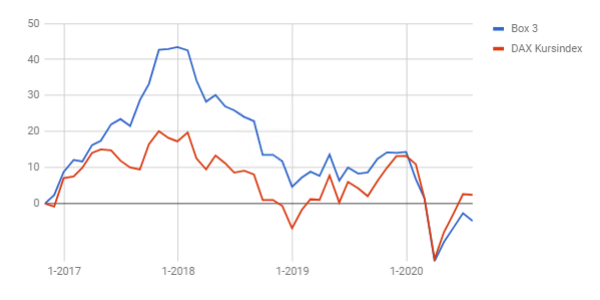

The DAX 30 outperformers

The gross return of the stock-box versus the DAX index since 1.11.2016. Costs and dividends are not included. Leverage is not used.

The stock-box outperforms the index.

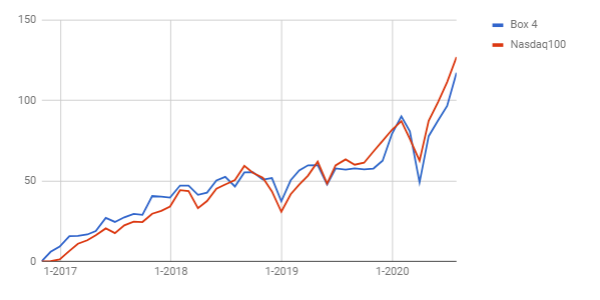

The NASDAQ 100 outperformers

The gross return of the stock-box versus the NASDAQ 100 index since 1.11.2016. Costs and dividends are not included. Leverage is not used.

The stock-box outperforms the index.

Enjoy our legendary service

Our support desk is quick, professional and reliable. Clients frequently express their satisfaction.

"Extremely focused on client needs. Really outstanding. Top broker." – M.R.

"Constant quality service since the beginning." – A.L.

WH SelfInvest has a long history of broker awards and is in good standing with all its regulators.

A low cost service

Budget

- No management fee.

- No performance fee.

- No exit cost.

| Stock-box fee | € 120 per stock-box per year, charged at the start for two years. | |

| Set-up fee | € 155, charged one time only. | |

| Order commissions | The same low commissions as clients who place their own orders. | |

Frequently asked questions

| 1. Is there a minimum investment? |

|---|

| No, there is no minimum investment. Logic dictates, however, that too small an investment is not cost effective. There are also stocks, like Google, which have very high values. Hence you should consider at least € 1.000 per stock position. |

| 2. Why is the cost of the stock-box service so low? |

| The service uses Nobel Prize logic, freely available. It has no need for expensive stock analysts, portfolio managers and relationship managers. |

| 3. How do I monitor my portfolio? |

| You can monitor the performance of your portfolio in real-time via PC, tablet or smartphone. |

| 4. Do I need to subscribe to the NanoTrader

trading platform? |

| Not if you do not want to. The free tablet and smartphone platforms are sufficient to monitor your portfolio. |

| 5. Can I stop the service whenever I want? |

| Yes, you can stop the service whenever you want. There is no exit cost. Any fees which have been charged cannot be refunded. |

| 6. Do I need more than one stock-box? |

| It depends. In order to diversify risk, a good

stock portfolio should at least contain 12 stocks

from various industries. If you already have stocks

you could select only one stock-box. If you have no

other stocks, a minimum of two stock-boxes is

better. |

| 7. Can I change stock-boxes? |

| Yes, whenever you want. Changing stock-boxes is free. |

| 8. When are the stock-boxes updated? |

| The stock-boxes are updated the first week of every month. |

| 9. What do I need to do? |

| If you want your portfolio to update automatically, you only need to click "Yes" in the instruction link in the e-mail which you receive once a month. |

| 10. How are my positions updated? |

| Stocks are sold and bought at the market price. The available cash is split equally between the new positions on a per box basis. |

| 11. Which stocks are currently included in the stock-boxes? |

| All 38 stocks currently included in the

stock-boxes can be found in the free monthly

information sheet. Download the stock-box information sheet You can also install the free SignalRadar App and see the stock-box positions in real-time. |

Sign up for the Stock-box service

Step 1

Open a stock account and add a copy of the stock-box information sheet to your application. Indicate on the sheet which stock-box(es) you want. Your new account must be funded within four weeks.

Step 2

An e-mail with an electronic request to pay the fees is send to you. When the fees are paid (credit card or paypal) and the account is funded, the stock-box(es) you selected are implemented on your account. You will receive a confirmation when this has been done.

Step 3

Every month you receive the e-mail containing the new stocks and the stocks which need to be removed from your portfolio. Simply click the "Yes" link to update your portfolio.