Zigzag trendline trading – Erdal Cene

Description

This drawing tool supports the trading approach of trader Erdal Cene, author of the book Professioneller Börsenhandel (ISBN 978-3-89879-667-5).

Click the ![]() icon to activate the drawing tool. Draw what you consider to

be the first phase of the current trend. There is no need to

draw the full trend, only draw what you consider to be the

beginning of the trend. The platform will continue to draw the

trend (zigzag trendline) until the trend reverses.

icon to activate the drawing tool. Draw what you consider to

be the first phase of the current trend. There is no need to

draw the full trend, only draw what you consider to be the

beginning of the trend. The platform will continue to draw the

trend (zigzag trendline) until the trend reverses.

Drawing the first phase of the trend in a logical way is crucial. It determines all other parameters of the strategy. The dedicated section "Drawing the zigzag trendline" below explains this action in more detail.

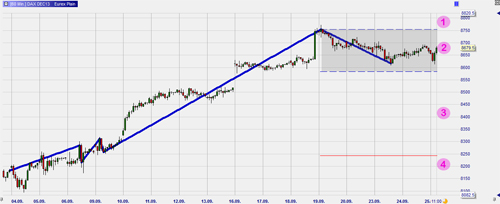

The drawing tool divides every chart into 4 zones based on the zigzag trendline and the current market price. Let's start with a situation in which the current trend is bullish.

The 4 chart zones are the following:

Zone 1 - the trend continuation zone. In this zone the market is going in the direction of the trend. The tool will continue to extend the trendline if further highs are reached. There are no trading opportunities in this zone.

Zone 2 - the sideways zone. In this zone the market is going sideways. In this zone there are no trading opportunities.

Zone 3 - the buy zone. In this zone the market has gone down but the bullish trend is intact. This zone offers buy opportunities. The author does not indicate when to buy. He rightly suggests that the type of signal used is less important than correctly identifying the buy zone. Each trader should pick the signal type(s) which he prefers. In his book the author analyzes several signal types such as hammer candles, market structure points and support levels.

This example shows the EUR/USD in a bullish trend. Nevertheless the currency has dropped below the sideways zone (blue dotted lines) and is now in the buy zone.

Trader Erdal Cene insists …

- a trader must buy each time there is a buy signal in the buy zone. A signal can either result in a profitable or a non-profitable trade. One does not know in advance. Hence the importance of reacting to all signals. It is the only way the trader can make certain he is in position for the big, profitable trades.

- a trader must curb his natural reflex to not trade or, even worse, to short sell when the market is very low in the buy zone. Indeed, the lower the market in the buy zone, the stronger the argument to buy. These are the occasions when the potential profit is at its highest. Hence the buy zone is green at the bottom and only grey-green at the top. As visually indicated by the crosses, never buy below the buy zone.

Zone 4 - the end-of-the-trend zone. The red line indicates the level at which the current trend comes to an end. Once the candle closes below this line, the drawing tool will stop drawing. The red line is based on the zigzag trendline. It is, however, not simply the low of the last progression. In order to take into account market volatility around this key level the red line is calculated using the instrument’s ATR.

In this example the bullish trend on WTI Crude Oil has come to an end when the market closed below the red line. The drawing tool stopped drawing.

Let’s now look at a situation in which the current trend is bearish.

This example shows WTI Crude Oil in a bearish trend. Nevertheless the price has risen above the sideways zone (blue dotted lines) and is now in the short sell zone.

In this example the bearish trend on EUR/USD has come to an end after the market closed above the red line. The drawing tool stopped drawing.

Drawing the zigzag trend line

The "only" thing a trader needs to do is draw the initial phase of the trend. At first glance this is simple, but there is more to it. The initial phase of the zigzag determines all other parameters. The location and the span of the initial phase must stand in relation to the time frame in which the trader trades. Also watch these videos:

Video: Drawing and sliding the first phase of the zigzag trendline

Video: Twincharts and combining multiple timeframes

Video: Examples small timeframes (1’, 5’ …)

Video: Examples medium timeframes (10’, 15’ …)

Note: the drawing tools are not available in the demo. They are reserved for clients.